The Cash-Free Revolution: How Cashless Payments are Boosting Dispensary Performance

In today’s rapidly evolving cannabis retail landscape, dispensaries are discovering a powerful truth: cashless payment options aren’t just convenient—they’re transformative for business performance. Recent data reveals compelling evidence that embracing debit payments can significantly enhance dispensary operations, customer satisfaction, and bottom-line results.

The Numbers Don’t Lie: Cashless Payments Drive Revenue

According to Flowhub’s analysis of Green Wednesday 2023 data, dispensaries that accept debit card payments earned an average of $4,627 more per day compared to cash-only operations. This substantial revenue difference highlights how payment flexibility directly impacts sales potential.

The performance boost extends beyond daily revenue:

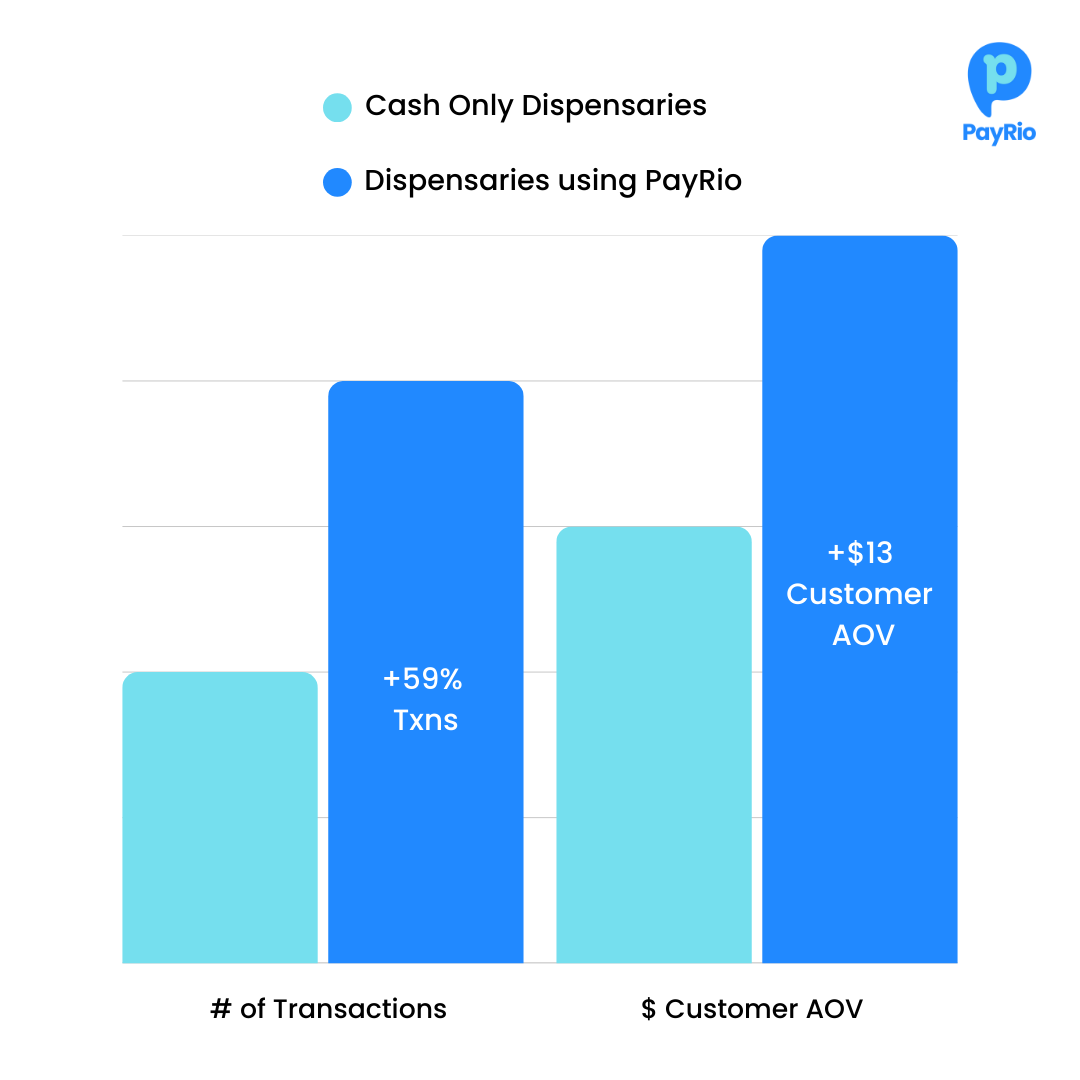

- Dispensaries offering debit payments processed 59% more transactions than cash-only competitors

- Transactions made with debit cards averaged $13 higher than cash transactions

- In 2024, cash payments represented just 16% of all transactions across industries

Why Cashless Options Matter in Cannabis Retail

Enhanced Customer Experience

Despite the cannabis industry’s cash-heavy history, consumer preferences are clear. Today’s cannabis consumers, like shoppers in every other retail sector, expect the convenience of cashless payment options. By meeting this expectation, dispensaries create a more familiar and comfortable shopping experience.

Improved Security and Operational Efficiency

Cash-intensive businesses face significant security challenges. With large cash reserves, dispensaries become targets for theft and robbery—a growing concern across the industry. Cashless payment systems reduce on-site cash, minimizing this risk while simultaneously streamlining operations by:

- Eliminating time-consuming manual cash counting

- Reducing human error in transaction processing

- Providing better compliance tracking and tracing

- Integrating seamlessly with inventory management systems

The Expanding Cashless Landscape for Dispensaries

While federal restrictions still limit traditional credit card processing for cannabis businesses, several viable cashless options have emerged:

1. ACH Electronic Transfers

Automated Clearing House (ACH) transfers have become one of the most reliable cashless payment methods available to cannabis retailers. In 2024 alone, more than 33 billion payments were processed through ACH networks. This payment method allows:

- Direct bank-to-bank transfers

- Instant payment verification

- Seamless integration with dispensary POS systems

2. Cashless ATM Solutions

Despite some regulatory challenges, properly implemented cashless ATM solutions remain popular among dispensaries seeking payment alternatives. These systems:

- Connect to ATM networks for direct bank account payments

- Eliminate physical cash exchange

- Reduce transaction times and improve customer flow

Future Outlook: The Growth Trajectory of Cannabis Payments

The cannabis payments landscape continues to evolve rapidly. Industry projections paint an exciting picture for the future:

- The US cannabis industry is expected to reach approximately $45 billion in revenue by 2025

- Sales are projected to grow by 12.1% from 2024 to 2025, reaching $35.2 billion

- More states are providing tax relief by decoupling from section 280E restrictions

- Payment innovation continues as the industry adapts to regulatory challenges

Implementing Cashless Payments: Best Practices

For dispensaries looking to implement cashless payment options, consider these key factors:

-

Choose an unintegrated solution: Look for payment processing that operates independently from your POS system to protect overall business continuity. When payment systems run separately, POS outages won’t affect your ability to process payments, ensuring you can continue serving customers even during technical difficulties

-

Prioritize compliance: Ensure your payment provider understands cannabis-specific regulations and maintains rigorous compliance standards

-

Consider customer education: Implement clear signage and staff training to help customers understand available payment options

-

Evaluate security features: Select solutions with robust security measures to protect both business and customer data

Conclusion: Embracing the Cashless Future

The data is clear—cashless payment options deliver significant advantages for cannabis dispensaries. With higher transaction values, increased customer volume, and substantial daily revenue gains, the business case for implementing debit payment options is compelling.

As the cannabis industry continues its rapid growth and maturation, dispensaries that embrace payment innovation position themselves for success in an increasingly competitive market. The trend toward cashless transactions will only accelerate throughout 2024 and beyond, making now the perfect time for dispensaries to evaluate and implement these performance-boosting payment solutions.

Contact PayRio today to learn about our payment solutions designed specifically for cannabis dispensaries. Our team of industry experts can help you implement a secure, compliant payment system that increases your daily revenue, improves transaction values, and enhances the overall customer experience. Don’t let your dispensary fall behind in the cashless revolution!